Weyay

Helping young Kuwaitis get a better grasp on their financial planning

Role:

Sr. Product Designer

Duration:

8 months

Contribution:

Interaction Design

UI Design

Design Systems

Platform:

iOS & Android (Native)

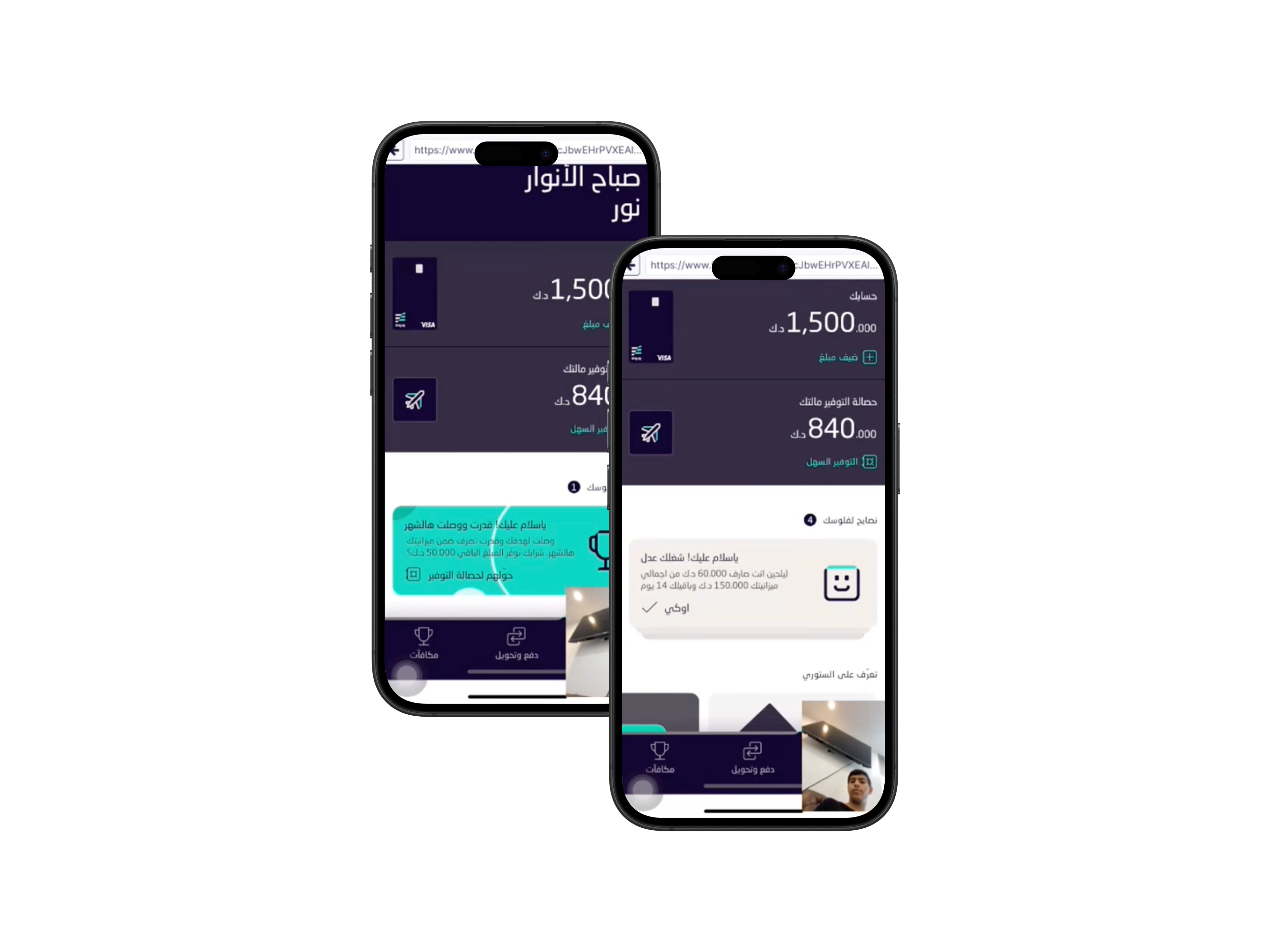

National Bank of Kuwait launched the first fully digital bank in Kuwait called Weyay (‘with me’). Built from the ground up, the ambition of Weyay was to build a world-class banking experience for young Kuwaitis.

Weyay was brought to life through unique features, initially launching with fast digital onboarding, fully digital account management, and allowance transfer (young citizens receive a regular allowance from the state). In later releases, differentiators such as quick P2P payments, savings pots and budgeting & tracking.

(Illustration credit goes to Tom Strand)

Designed to serve the financial and lifestyle needs of

shabab

(Kuwaiti word for youth)

1 year after launching:

4.4/5 rating (Apple Store)

90.000 Customers (3x Target)

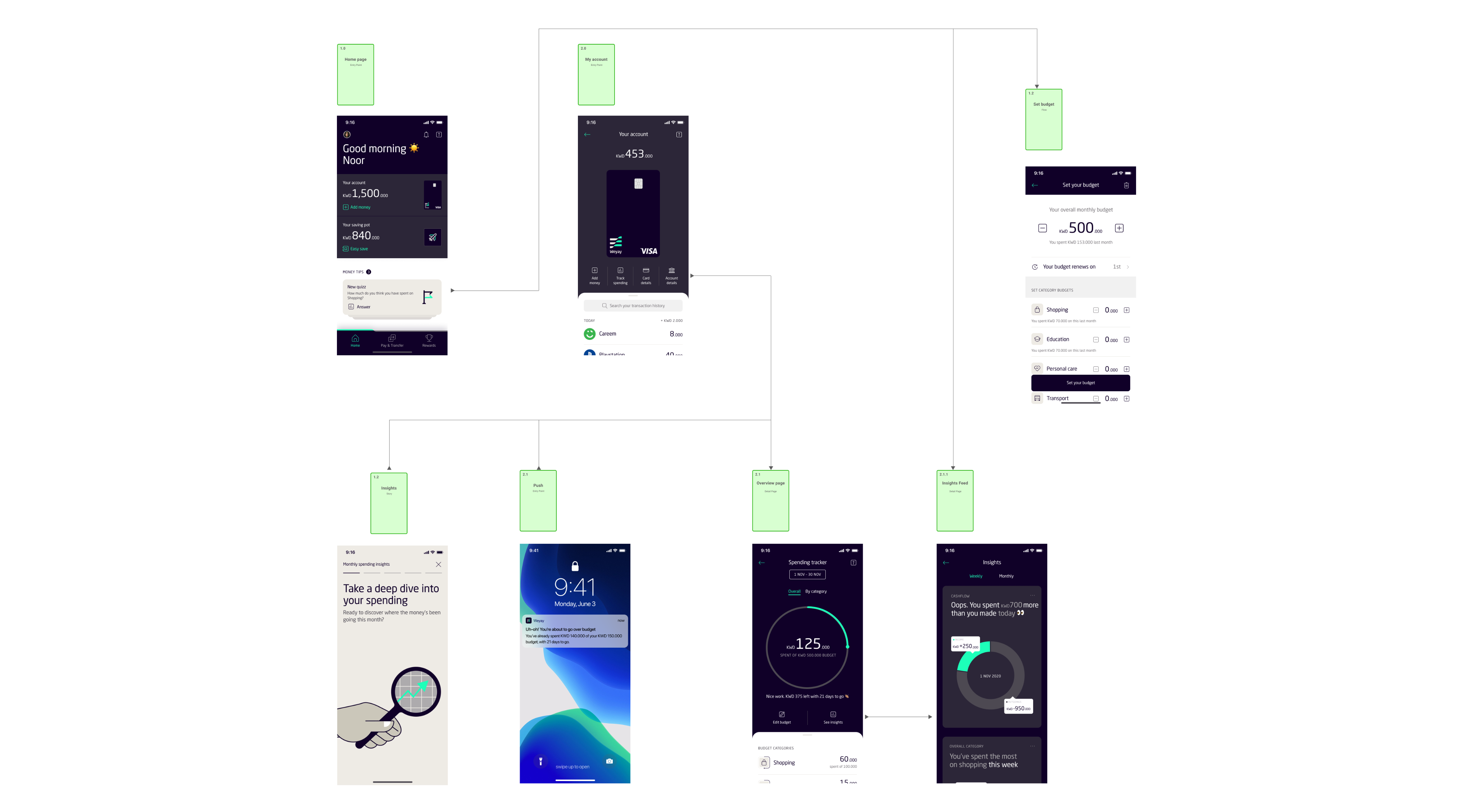

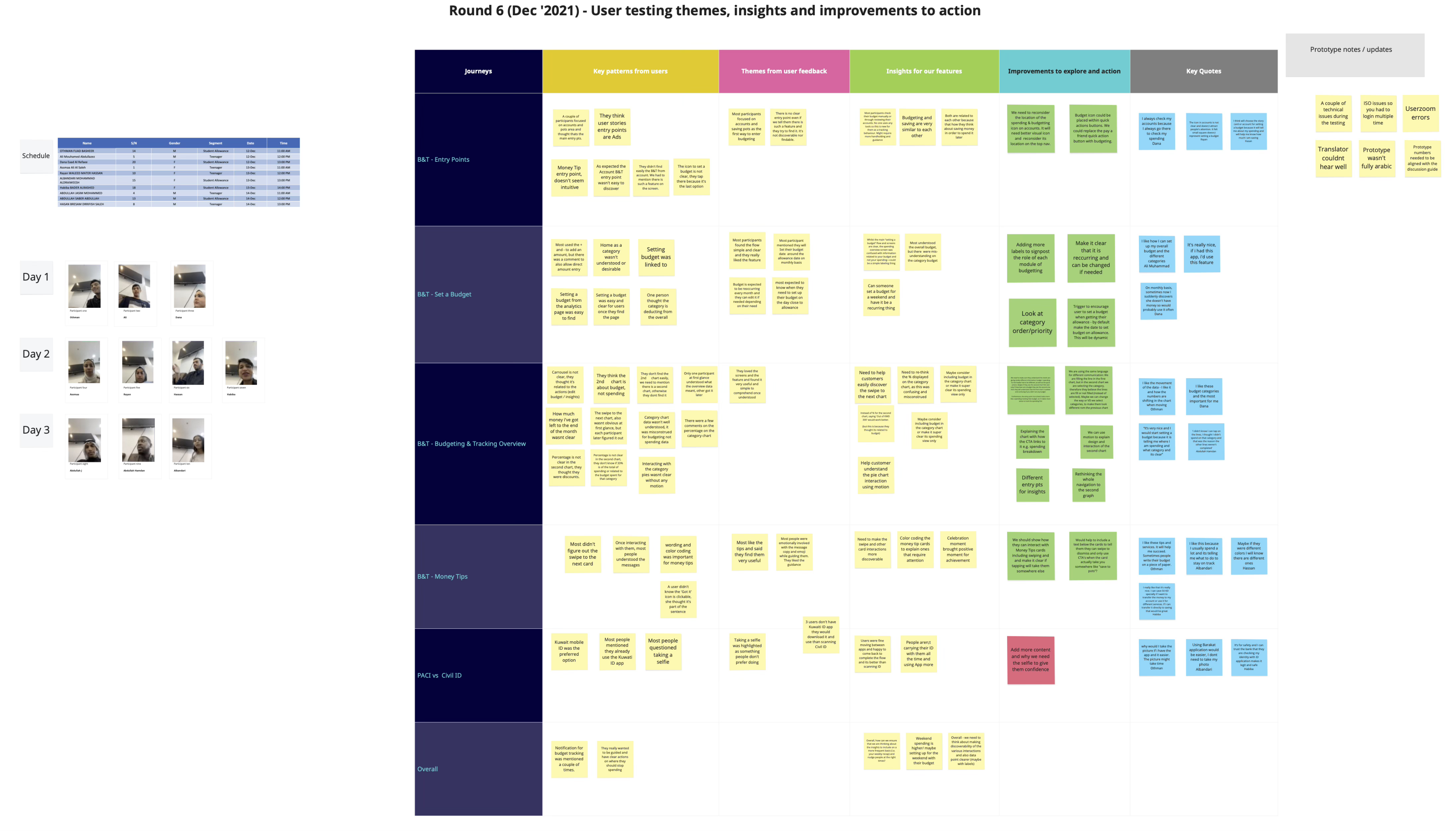

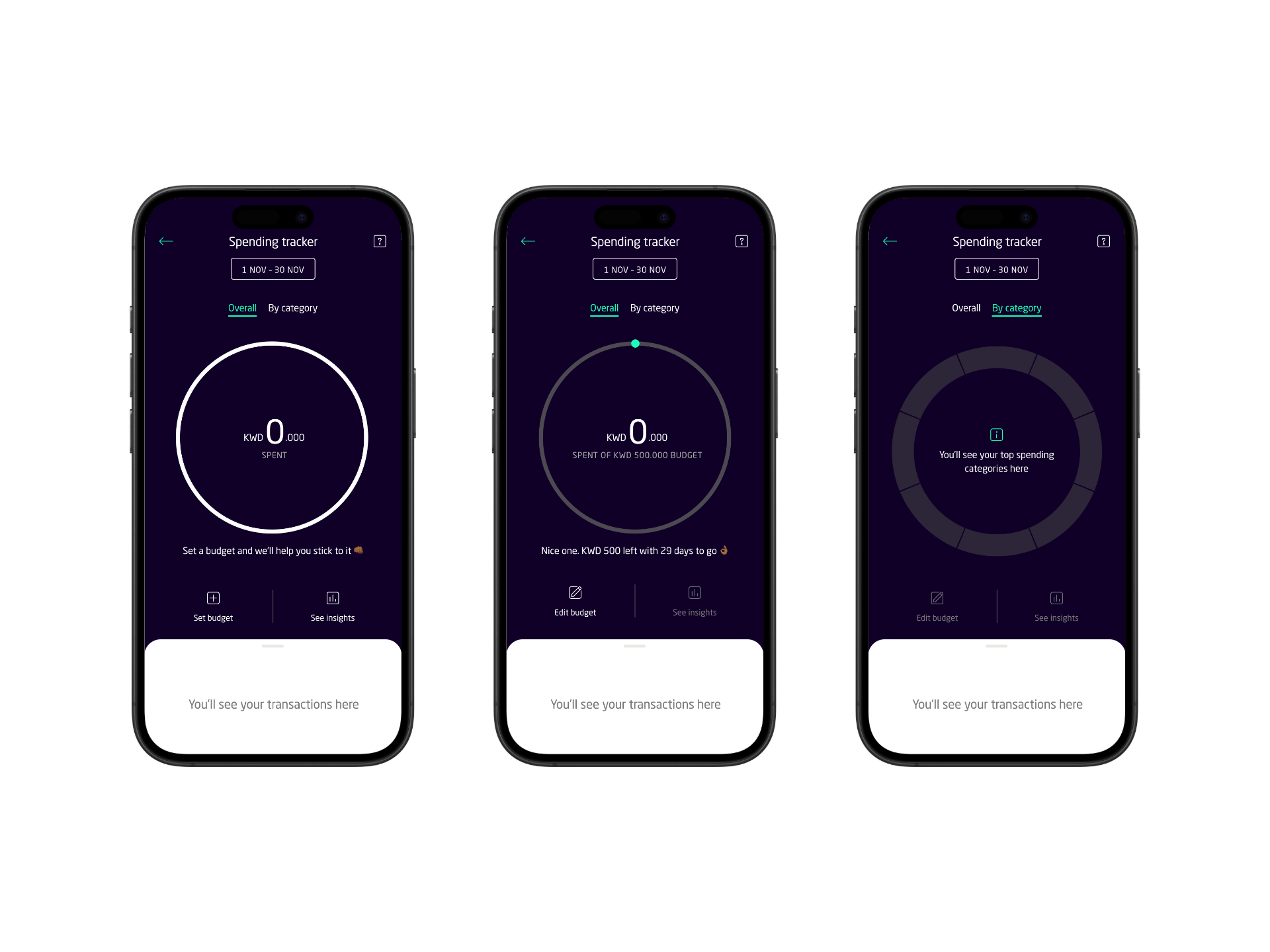

The placement of the budget feature need to ensure the categorization, budgeting and saving features are interinked as they should be designed to work in tandem.

Each exploration focused on how these elements could work in tandem, creating a seamless flow where users could see where their money goes, set limits, and monitor outcomes without friction.

We conducteed testing with Teenagers and young adults

(5 teenagers, 5 students)

Back to Home

guillem.ruiz@outlook.com

© 2025

Weyay

Helping young Kuwaitis get a better grasp on their financial planning

Role:

Sr. Product Designer

Duration:

8 months

Contribution:

Interaction Design

UI Design

Design Systems

Platform:

iOS & Android (Native)

National Bank of Kuwait launched the first fully digital bank in Kuwait called Weyay (‘with me’). Built from the ground up, the ambition of Weyay was to build a world-class banking experience for young Kuwaitis.

Weyay was brought to life through unique features, initially launching with fast digital onboarding, fully digital account management, and allowance transfer (young citizens receive a regular allowance from the state). In later releases, differentiators such as quick P2P payments, savings pots and budgeting & tracking.

(Illustration credit goes to Tom Strand)

Designed to serve the financial

and lifestyle needs of

shabab

(Kuwaiti word for youth)

1 year after launching:

4.4/5 rating (Apple Store)

90.000 Customers (3x Target)

The placement of the budget feature need to ensure the categorization, budgeting and saving features are interinked as they should be designed to work in tandem.

Each exploration focused on how these elements could work in tandem, creating a seamless flow where users could see where their money goes, set limits, and monitor outcomes without friction.

We conducteed testing with Teenagers and young adults

(5 teenagers, 5 students)

Back to Home

guillem.ruiz@outlook.com

© 2025

Weyay

Helping young Kuwaitis get a better grasp on their financial planning

Role:

Sr. Product Designer

Duration:

8 months

Contribution:

Interaction Design

UI Design

Design Systems

Platform:

iOS & Android (Native)

National Bank of Kuwait launched the first fully digital bank in Kuwait called Weyay (‘with me’). Built from the ground up, the ambition of Weyay was to build a world-class banking experience for young Kuwaitis.

Weyay was brought to life through unique features, initially launching with fast digital onboarding, fully digital account management, and allowance transfer (young citizens receive a regular allowance from the state). In later releases, differentiators such as quick P2P payments, savings pots and budgeting & tracking.

(Illustration credit goes to Tom Strand)

Designed to serve the financial

and lifestyle needs of

shabab

(Kuwaiti word for youth)

1 year after launching:

4.4/5 rating (Apple Store)

90.000 Customers (3x Target)

Outstanding Innovation in Mobile Banking & Best digital bank in the Middle East (2022) by

The placement of the budget feature need to ensure the categorization, budgeting and saving features are interinked as they should be designed to work in tandem.

Each exploration focused on how these elements could work in tandem, creating a seamless flow where users could see where their money goes, set limits, and monitor outcomes without friction.

We conducteed testing with Teenagers and young adults

(5 teenagers, 5 students)

Back to Home

guillem.ruiz@outlook.com

© 2025